Nvidia had a tumultuous week as its stock soared to record highs, only to face sudden reversals amidst debates on Wall Street about the sustainability of its impressive rally.

Bank of America acknowledged the rapid surge in Nvidia’s stock on Thursday, warning of potential profit-taking but reiterating its Buy rating with a $150 price target, labeling Nvidia a “top pick.”

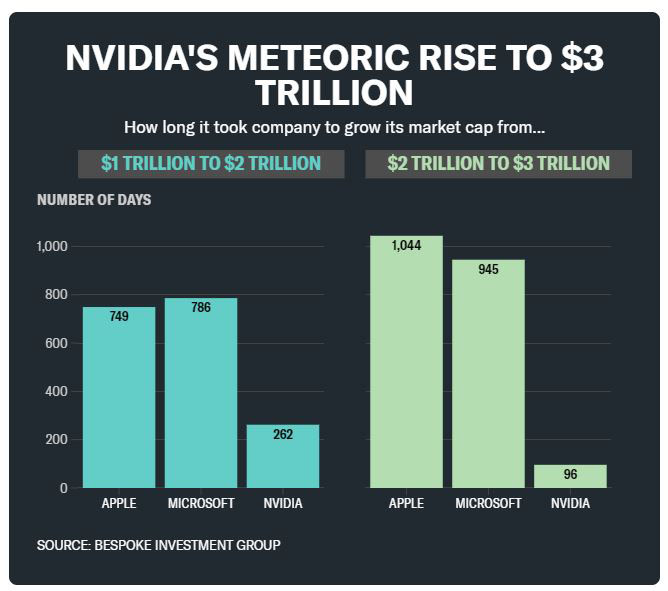

During the week, Nvidia briefly surpassed Microsoft to become the world’s most valuable company, yet by week’s end, its market cap slightly decreased to approximately $3.12 trillion, slightly below Microsoft’s $3.33 trillion.

In an interview with Yahoo Finance, Patrick Moorhead, founder and CEO of Moor Insights & Strategy, cautioned investors. Moorhead predicted Nvidia’s dominance would likely continue for the next six to nine months but urged vigilance for signs of market corrections.

“Investors should monitor downstream profitability intricacies within Nvidia’s ecosystem,” Moorhead advised. He emphasized the impact on software giants like Adobe, Salesforce, SAP, and ServiceNow, stating, “If businesses and consumers aren’t willing to pay premiums for Nvidia’s AI advancements, the entire gravy train could come to a halt, reminiscent of the dot-com bubble burst.” Moorhead also highlighted increasing competition as a potential threat to Nvidia’s pricing power.

Despite these challenges, optimism surrounding Nvidia’s growth remains strong, fueled by substantial investments in artificial intelligence (AI). Nvidia’s latest quarterly report boasted a significant 262% revenue increase alongside a remarkable 461% year-over-year surge in adjusted earnings.

Furthermore, Nvidia recently executed a 10-for-1 stock split and doubled its quarterly cash dividend, mirroring moves made by other tech giants. Year-to-date, Nvidia has surged by approximately 160%.

Despite its lofty valuation, analysts anticipate Nvidia reaching a market cap of $4 trillion. Moorhead commented optimistically, “I don’t see any reason it couldn’t reach $4 trillion,” citing market expectations and Nvidia’s high price-to-earnings ratio. He underscored the importance of positive signals from downstream players to sustain this momentum.

Wedbush analyst Dan Ives echoed similar sentiments, predicting a competitive race among Nvidia, Apple, and Microsoft to achieve a $4 trillion market cap in technology. Ives highlighted the burgeoning AI revolution, driven by accelerated investments in data centers by tech giants. He projected global AI spending could exceed $1 trillion over the next decade, with a majority of enterprises adopting AI applications.

“It’s like being at a party at 9 PM that’s going strong until 4 AM, with the entire tech industry now joining in,” Ives commented, emphasizing the expansive potential of AI technologies.

Looking ahead, Nvidia confronts challenges in maintaining momentum amidst competition and market volatility. While recent performance has been impressive, the company’s valuation and market leadership will depend on broader economic conditions and technological advancements in semiconductors and AI.

In conclusion, Nvidia stands at a critical juncture, navigating unprecedented growth amidst heightened market scrutiny. As the technological landscape evolves, Nvidia’s strategic decisions, competitive positioning, and market reception to its innovations will shape its future trajectory.